Key takeaways

- QuickBooks Desktop 2020 is discontinued as of May 31, 2023, which means Intuit ended updates, support, or access to add-ons like payroll will be available.

- As of September 30, 2024, Intuit stopped selling new subscriptions for certain U.S. versions of QuickBooks Desktop, including Pro Plus, Premier Plus, and Mac Plus. Existing subscribers can continue to renew their subscriptions, but new subscriptions are no longer available.

- QuickBooks Online vs Desktop: QuickBooks Online is cloud-based, accessible anywhere, and integrates better, but it lacks some Desktop-specific features like sales orders, various costing methods, and industry-specific reports.

- Continuing to use QuickBooks Desktop 2020 is risky due to a lack of support, security updates, and potential data migration issues.

- Migration from QuickBooks Desktop to QuickBooks Online is possible but has limitations for large files, requiring manual workarounds for oversized data.

- Alternative software solutions like inFlow can replace lost features, offering inventory tracking, more costing methods, sales orders, and integrates with QuickBooks Online.

Intuit, the developers of the accounting software QuickBooks, announced that the 2020 version(s) of QuickBooks Desktop is now discontinued as of May 31st, 2023. Given the platform’s popularity, this announcement has raised several questions. What does this mean? What’s the future of QuickBooks Desktop? Is QuickBooks Desktop being phased out? If you’re using QuickBooks Desktop, what are your options going forward? What’s the difference between QuickBooks Online vs. Desktop?

Let’s dig in, and we promise we’ll be quick about it.

QuickBooks Desktop discontinued

While “QuickBooks Desktop Discontinued” is an accurate title, it doesn’t tell the whole story. Rather than completely shutting down, the 2020 version of QuickBooks Desktop is sunsetting. This means that while QuickBooks Desktop will remain available for current owners, it won’t see any further updates or support. It also means that QuickBooks Desktop users will lose access to any add-ons, including the popular payroll add-on. This has led many users to ask: is QuickBooks Desktop going away for good?

Is QuickBooks Desktop being phased out?

In short, not entirely. At least not yet.

In addition to discontinuing the 2020 version as of September 30, 2024, Intuit stopped selling new subscriptions for certain U.S. versions of QuickBooks Desktop, including Pro Plus, Premier Plus, and Mac Plus. Existing subscribers can continue to renew their subscriptions, but new subscriptions are no longer available.

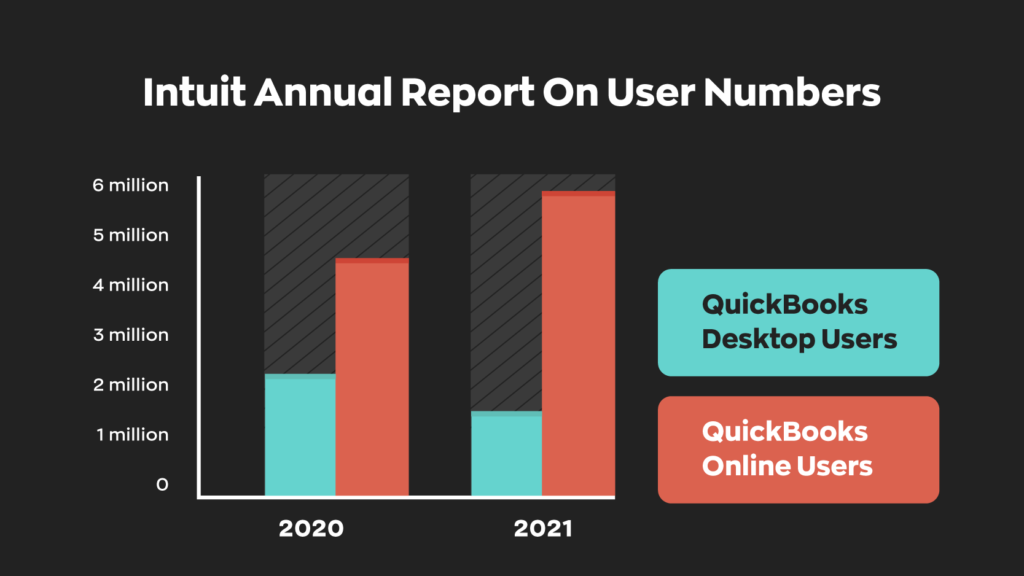

While there are still versions of QuickBooks Desktop that are available to users in certain regions, Intuit’s long-term intentions seem to be to phase out QuickBooks Desktop entirely at some point.

So, if you’re a current user of QuickBooks Desktop deciding how to move forward, consider these factors before making any decisions.

QuickBooks Online vs. QuickBooks Desktop: what’s the difference?

The most obvious choice for QuickBooks Desktop users would be to migrate to Intuit’s online version of the software, QuickBooks Online. So, let’s first look at QuickBooks Desktop vs QuickBooks Online to see how these two options compare.

QuickBooks Online

This version of Intuit’s accounting software is a cloud-based service. This means that users access the software through a web browser or application instead of using an on-board application. This requires an internet connection, but you can access it from anywhere that has one, regardless of distance.

QuickBooks Desktop

The desktop version of QuickBooks is intended as a local application, meaning you can only access it with the computer you install it on. You can install it on more computers in order to increase access points, but doing so incurs additional fees. Intuit also offers online hosting for QuickBooks Desktop, with fees starting at $44/month and up per user.

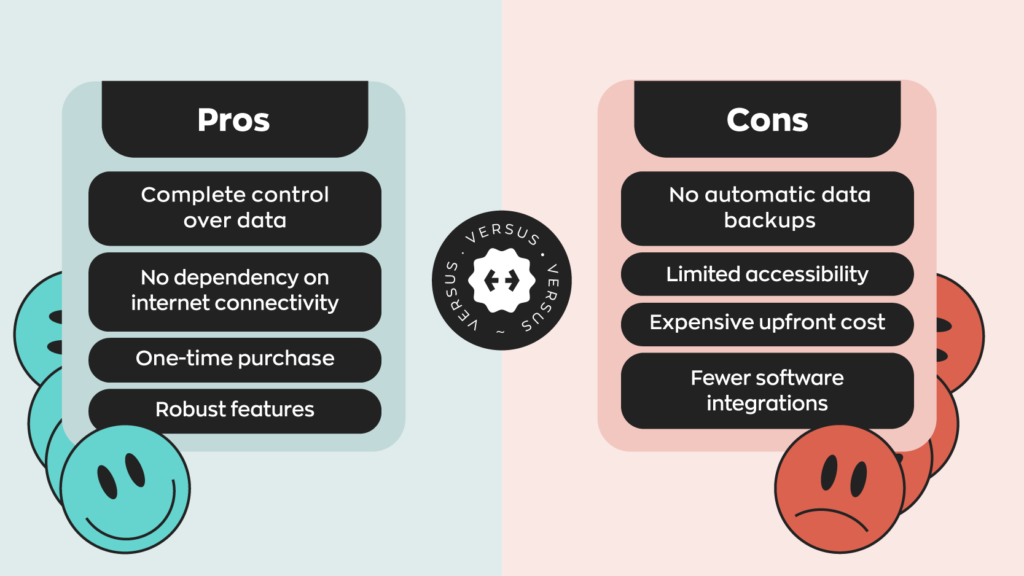

What features are missing in QuickBooks Online?

While both services have similar features, some are exclusive to specific versions. Here are the important ones.

Only QuickBooks Desktop offers sales orders. There are also ~50 more report types available to QuickBooks Desktop users than QuickBooks Online, and only QuickBooks Desktop offers industry-specific reports. Some features offered in QuickBooks Desktop are industry-specific. For instance, features tailored specifically for manufacturers, wholesalers, or nonprofit companies.

On the other hand, only QuickBooks Online is mac compatible. While it doesn’t offer as many reports as QuickBooks Desktop, it provides automatic invoicing and has significantly more integrations. QuickBooks Online also offers (optional) live bookkeeping support thanks to its cloud-based format. It’s also worth noting that, at the time of writing, only QuickBooks Online offers international invoicing.

The good news is there are other software solutions out there that can help replace the features lost if you move from QuickBooks Desktop to QuickBooks Online. More on that later.

Can you continue to use QuickBooks Desktop 2020?

Yes! But it’s a bad idea. A really bad idea. Part of the sunsetting process means that Intuit will be cutting live support for QuickBooks Desktop 2020. If something breaks, you’ll be on your own. In the worst-case scenario, you may end up being unable to migrate your data. You’ll have to start from scratch or transfer everything by hand– neither of which is particularly desirable.

QuickBooks Desktop 2020 will also stop receiving security updates, leaving your systems more vulnerable. Whether you switch to a newer Desktop version or jump to Online, switching off QuickBooks Desktop 2020 is a good idea.

How do you move from QuickBooks Desktop to QuickBooks Online?

With QuickBooks Desktop discontinued, many users will look to switch to the online version. Luckily, according to QuickBooks themselves, all you really need to do is copy & export a file. There are some limitations, though. If your file exceeds a certain size (750,000 targets), you won’t be able to convert it to QuickBooks Online. If your file exceeds this size, you’ll have to settle for exporting import and balance lists or start fresh.

Should you move to QuickBooks Online?

This is a tricky question to answer. No two businesses are the same, and every one of them has a different set of factors to consider. Making outright recommendations without this information would be irresponsible, but we can give you some things to consider.

It should be no surprise that a huge strength of QuickBooks Online is its cloud-based infrastructure. This allows for mobility that far exceeds the Desktop version. Instead of being bound to a specific computer, you’ll be able to access QuickBooks Online from any device with a browser.

However, we did mention there is an option to host QuickBooks Desktop online. But when you add in the hosting fee on top of the purchase of the software, it can be very cost-prohibitive. The hosting service alone starts at $44/month per user but, on average, ranges between $50-$60. In comparison, QuickBooks Online Plus is priced at $99/ month for five users.

While offering an affordable cloud-based system is certainly valuable, the most obvious reason to switch from QuickBooks Desktop to QuickBooks Online is to future-proof your business. Especially if you’re using QuickBooks Desktop 2020 because, over time, your system will become increasingly more vulnerable.

In addition, with no more updates, there’s a good chance that the software will eventually stop working altogether. Which could leave you in a tough spot if you’re no longer able to access important and sensitive data.

How inFlow’s integration with QuickBooks Online can help

It’s true that QuickBooks Online does offer a great alternative for anyone looking to migrate from QuickBooks Desktop, but the loss of certain features has many users frustrated. For instance, QuickBooks Desktop offers far more inventory costing methods, while QuickBooks Online only offers FIFO. Then there are the other features we mentioned above, such as sales orders and reporting.

Luckily, software solutions like inFlow are capable of filling in these missing pieces. With inFlow and QuickBooks Online working together, you get a lot of the missing functionality from QuickBooks Desktop. For example, inFlow is a complete inventory management system that supports various costing methods, including FIFO, LIFO, manual costing & moving average. We offer sales orders and inventory tracking, including setting reorder points. We also have a myriad of reports available to help fill the gaps.

The best part is inFlow conveniently integrates with QuickBooks Online, which offers a two-way payment sync option!

As you add more and more software, it’s essential that they integrate with each other seamlessly. inFlow boasts a myriad of integrations– ranging from QuickBooks to ecommerce platforms like Amazon. Our software works great for tons of small-to-medium-sized businesses working in manufacturing, field service management, wholesale, and more! So no matter your industry, inFlow has you covered!

I have QBD 2016 and I have been advised by my accountant to stay with a Desktop version as my business is vey small. I have been told that not all the info transfers and could be lost. What does your cheapest Desktop version cost?

Hey Roger,

Thanks for stopping by. If your accountant says sticking with a QBD version is best for you I would recommend QuickBooks Desktop 2023. You’ll have to contact the QuickBooks sales team directly and enquire about purchasing a license. They are steering heavily into QuickBooks Online these days and are encouraging their customers to make the switch so they don’t advertise QBD 2023 on their website. You can reach someone from QuickBooks at 1-877-683-3280 or through their website.

I hope this helps,

Jared

I am a small medical practice and have used QBD since 2007. I have been informed that QBO is NOT HIPAA compliant and if I wanted to use it, I would not be able to use most features of QB. (Check writing etc) Is there a push for QBO to be HIPAA compliant for those businesses that have to deal with health care?

Hey Christine,

As far as I know, QBO has no plans of making their software HIPPA compliant. In order to use QBO you would need to partner with a cloud storage partner that is HIPAA compliant so you can safety store protected health information (PHI) in the cloud. There are some things you need to consider when shopping around for a cloud storage partner. You should ensure they undergo yearly HIPAA compliance audits, are willing to sign a business associate agreement (BAA), and their cloud storage is trustworthy and responsive. There are a number of options out there so be sure to do your due diligence before you sign on with anyone. I hope this helps.

Cheers,

Jared

I’ve just started using QBO. Because QBD is no longer. I do not like!!! Our business is 5 employees. And there is so much unneeded . Payroll has been unfriendly compared to what I’m use to.

Hey Janice,

You’re not alone! We’ve heard a lot of people with grievances when migrating from QBD to QBO. It’s very likely QuickBooks will listen to their users and update the features and functionality in the coming years to more closely align with their past product offerings.

All the best,

Jared

I have qb pro on a subscription will this of upgraded to qb pro 2023 edition if so can I still use the after discontinuation of qb desktop as I don’t like qbo

Hey Jon,

Thanks for reading. I can’t say for sure what is going to happen with QB Pro subscribers. I would reach out directly to the people at QuickBooks to find out for sure.

Cheers,

Jared

It has been a few years since I used QB online.

Unlike desktop, it there was no list of open windows to switch to.

Also the ability to make customized reports was very limited and nearly as good as QB Desktop.

Hey Dan,

You aren’t alone in your sentiment. It seems a lot of QBD users aren’t satisfied with some of the features that have been omitted from QBO. Hopefully now that they are steering more toward QBO they will start introducing some of these popular features into QBO.

Cheers,

Jared

Our accountant says she has a couple of clients using QuickBooks Online and also a couple using QuickBooks Cloud. If QBO is in the cloud, what is QB Cloud? She says it is not the same as QBO. Trying to make decision to change from QBD now. Have a server on life support now and don’t want to have to invest in another.

Thanks for any help!

Hey Connie,

Thanks for reading. I understand the difference between QuickBooks Online and QuickBooks Cloud can be a bit confusing. Essentially QuickBooks Cloud is like a hybrid version of QBO and QBD, and is often referred to as QuickBooks in the Cloud. The difference between QBO and QBC comes down to the available features they offer. So which one you choose should depend upon which features you use/need the most. I would recommend reaching out to someone from the QuickBooks sales or support team and explaining to them what your workflow is, and they should be able to guide you to whichever software solution is the best fit for you. I hope this helps!

Cheers,

Jared

I’d like to raise several issues with your article.

First, you indicate that QBO is the only option for Mac users, completely overlooking the existence of the QuickBooks for Mac product. It’s also a locally-installed product, like Quickbooks Desktop Premier, not an online product.

Of course the Mac desktop version is now also being sold only on a subscription basis, like the Windows counterpart, thereby enormously raising the overall cost to most businesses using it over a multi-year period.

Second, I’m surprised that nearly every reviewer omits any mention of something that for my business is a deal breaker: a separate subscription is required for each company file. My business manages multiple real estate related LLCs, each completely independent business entities. In the QBO model, each company file requires its own subscription. This makes the cost prohibitively expensive.

And finally, on the issue of using an older Quickbooks desktop product past its “retirement date.” On some levels it’s a “really bad idea,” as you say; specifically if for example in 2025 you decide to move from your 2020 version to the then-new version. It is conceivable that there will not be an upgrade path from 2020 to 2025, without having passed through 2023 or something in between. It would be criminal, but certainly something that these companies get away with. And second, the lack of customer support that a user might experience in the day to day use of the product is not such a big deal. Intuit’s direct support kinda sucks anyway, and there are many many users at least of the Windows products, far fewer of the Mac product (which I use, grudgingly).

All in all, while Intuit is definitely trying very hard to steer people over to the online version, it is certainly not for everyone, and their business and pricing models need a lot of work before they come close to offering what some of us would be looking for. If they don’t do that, it’s pushing long-time customers like us to consider looking outside of the Intuit universe for our business solutions.

I’m currently using Quickbooks 2020 desktop, will I be able to continue to use this version for the next 5 to 10 years ?

Hey Annand,

The short answer is yes you can continue using it indefinitely to my knowledge. However, with this sunset it means that any support for the software will end, meaning if something goes wrong you’re on your own, which for some businesses could be very risky. If something breaks you may end up loosing data, or being unable to mitigate your data over to a newer version of the software. Also I should note that there will no longer be any updates to the software’s security, leaving you much more vulnerable. I hope this helps!

Cheers,

Jared

I have 5 small companies under one QBD 2020. To switch to QBO we have to pay monthly per EIN. Do you know if QBD 2023 also works per EIN or will I be able to continue using one QB for all 5 companies?

Hey Shelly,

To my knowledge you only need to pay per EIN for the QBO version of the software, so QBD 2023 should be the same as the 2020 version in that regard. I would recommend reaching out to the team at QuickBooks to find out for sure one way or another though. I hope this helps!

Cheers,

Jared

We were forced to migrate to QBO (or so we were told) because of payroll. It has been an absolute nightmare. None of our previous accounting totals migrated correctly and we no longer have access to our previous information. I have spent countless hours with customer service and no one has been able to “fix” anything. Paychecks are wrong, tax totals are wrong and that is a major problem. We can’t go in and make corrections ourselves, it has to be correct “through the back door” as they say. We have been charged a full months fee for both services and have not been able to use. Complaints seem to fall on deaf ears. We are looking into other options

Ihave QBDesktop 2020 seemed likethe only option was QB online,nowIfind outthat Icouldhave opetd 2 for 2023 Pro I only have 5 employees,my boss hates the reports specially the unpaid bills

on desktop they were customized andso much easierto read.

ifIgo and purhase 2023 pro can the last few weeks be migrated back to desktop?

Hey Sara,

I’m not sure how data migration works from QBO to QBD. I would reach our the QuickBooks support team directly and ask them whether or not this is feasible before you make any decisions. I would hate for you to lose any of you data. I hope this helps.

Cheers,

Jared

We use QBD for almost 30 years. We love it. We switched some companies to QBO and we hate it so much. The function is very limited not like QBD. QBO use # to replace “class” but I can not put # for each item. No list of windows is very inconvenient. I have cancelled my QBO subscription and switched back to QBD. If QBD is being phased out then I would rather look for other Accounting software.

Hey Kathy,

I’m sorry to hear about your experience with QBO. We’ve been hearing similar feedback from other QBO users who migrated from QBD. We can only hope that QuickBooks will add some of the missing features from QBD over to QBO now that they are starting to phase out QBD. Some of our customers are using Xero as an alternative to QBO. I would recommend looking into them if you’re searching for an alterative to QBO.

Cheers,

Jared

Hello,

it appears that quickbooks desktop is not been sunsetted but completely closed as there is no access to it at all?

Hey Jonathan,

Thanks for reading. You will in fact still be able to use the program, however as mentioned in the article there are some caveats to consider.

Cheers,

Jared

I am using QBD 2020 without the payroll services. Payroll is very small, salary-based and never varies within the calendar year so I use the manual payroll function. If I migrate to QBO 2023 or QBD 2023, will I still be able to process payroll in the same manner?

Hey Bonnie,

I’m not entirely sure how specific features will translate between versions of QuickBooks. To get a better idea of what your new workflow would look like I would recommend reaching out to someone from QuickBooks before you make any decisions on which version would work best for you.

Cheers,

Jared

I have just migrated to QBO from QBD 2020, I find it extremely complicated to use and as there are only 2 employees in our company would it be worthwhile me staying with desktop

Hey Lesley,

If you think you can continue to operate using QBD 2020 you may consider sticking with it. However, if you do run into any issues down the line you’ll be on your own, and you could risk losing a lot of valuable data. I would consider sticking with QBO, and see if it gets any better with time. From what we’ve heard QBO has a bit of a learning curve, but if you stick it out you’ll be future-proofing your business. Ultimately everyone’s situation is different and only you can decide what’s best for your business.

Cheers,

Jared

Good replies to most comments.

I use QBD Accountant 2022 for my 20 clients. I use a company called Pay Window Payroll for desk top payroll service.

Does a CBO subscription have a single license cost and then whatwould be the EIN per client cost?

Hey David,

Unfortunately you’ll need a separate QBO license for each EIN. This is one of the major differences between QBD and QBO and many users have been expressing their grievances. However I believe there are options available for accountants to get discounted rates when they purchase multiple licenses. I would recommend giving their sales team a call and inquiring about this option if you’re thinking of moving over to QBO. I hope this helps!

Cheers,

Jared

I’m an independent management consultant and use QBD for Mac 2020. I’m trying to determine if I need to switch to the new online version and if so, which one. About my business: I work on retainers with clients and typically generate no more than 10 invoices per month. ( I’m invoicing mostly for professional fees and occasionally for expenses). Some ov my clients pay via ACH, others by traditional paper check. Bottom line, things are pretty simple in this regard and I don’t require a lot of bells and whistles. For example, I don’t need a payroll feature nor do I need sales tax updates. Now that QBD for Mac 2020 has been sun-setted by Intuit, will I be able to generate invoices and link payments (ie deposits) to my business bank account? I also would like to use my QBD for Mac 2020 for my personal checking account. Thanks in advance for your thoughts and suggestions..

Hey Andre,

QBO for mac comes in three options, Simple Start($30/mo), Essentials($55/mo), and Plus($85/mo). It sounds like for your needs the Simple Start option would be all you need as it has invoice and payments included. As far as ACH payments I’m not sure exactly how that would work. I know QBO works together with Online Bill Pay to let you send ACH so I would assume it could also work to receive payments, but I would look into this to confirm. I would recommend reaching out the either the sales or support team at QuickBooks and explain to them your general workflow and needs. From there they should be able to point you toward the best solution for you. I hope this helps!

Cheers,

Jared

Thanks Jared, much appreciated.

I am an accountant who has work in both QBD and QBO. I really dislike the online version. It’s functionality falls very short. It’s cumbersome and not user friendly (most menu functions are elusive). As an accountant, I will never recommend QBO to a client. I am currently looking into other accounting solutions in the event Intuit does away with with QBD.

Intuit, stop reinventing the wheel!! If something works well, KEEP IT!

Hey Melissa,

Thanks for reading, and we hear you! As you can see by the comments above there are a lot of people who are unhappy about the variances in QBO and QBD. The best we can hope for is that Intuit will start implementing some of the missing functionality into QBO. All the best.

Cheers,

Jared

Couldn’t agree more with Melissa. Quickbooks has sold out the small business owner and ag producers. I have had Quickbooks for 21 years and have absolutely never been as frustrated as I am now.

Do you think there will be a Desktop 2024 version this fall?

Hey Jackie,

Thanks for reading. Unfortunately I doubt QuickBooks will be releasing any more versions of QuickBooks Desktop. Of course I can’t say that for sure but it seems they are leaning heavily into QBO and trying to steer their existing QBD customers into adopting QBO. I hope this helps.

Cheers,

Jared

Hi! I have qb2022; any word on how long that will be supported? From the above comments I am not looking forward to qbo.

Hi Diane,

No word on if/when QuickBooks will stop support for other products. They are keeping that information pretty close to the chest, but I would assume eventually they’ll be stopping support for all QBD products. The good news is, QuickBooks will more than likely give their users ample notice before they discontinue support for any of their products. If you’re currently enjoying QBD2022 I would recommend sticking with it for as long as you can. There is a very good chance that QBO will be implementing a lot of the missing features from QBD versions in order to please their customer base. I hope this helps!

Cheers,

Jared